Aadhaar Card Linking With PAN Card

The Government of India has made it required for all people to connect their Aadhaar number with their Dish number. This due date was as of late expanded up to 31st December 2019. It is fundamental to cite and connect Aadhaar number whereas recording ITR unless particularly exempted. It ought to be famous that an person cannot record his/her ITR without connecting both.

There have been various hypotheses on the Government’s arrange for Aadhaar connecting with different open and private administrations profited by citizens over the nation. On September 26th of 2018, the Incomparable Court of India announced the Government’s Aadhaar conspire as intrinsically substantial but ruled against a few of its arrangements counting its connecting with bank accounts, portable phones and school confirmations. In any case, it maintained Segment 139AA of the Salary Assess Act that orders the connecting of Dish with Aadhaar to total IT returns filing.

The recently overhauled Wage Assess e-filing entry makes it a breeze to interface your Dish with Aadhaar to encourage helpful recording of your Pay Assess returns from the consolation of your home.

There are 3 ways in which an person can do this.

If you’re a enrolled client of the Pay Assess e-Filing portalOn the homepage of the Wage Assess e-Filing entrance for non-registered users

Linking through SMS

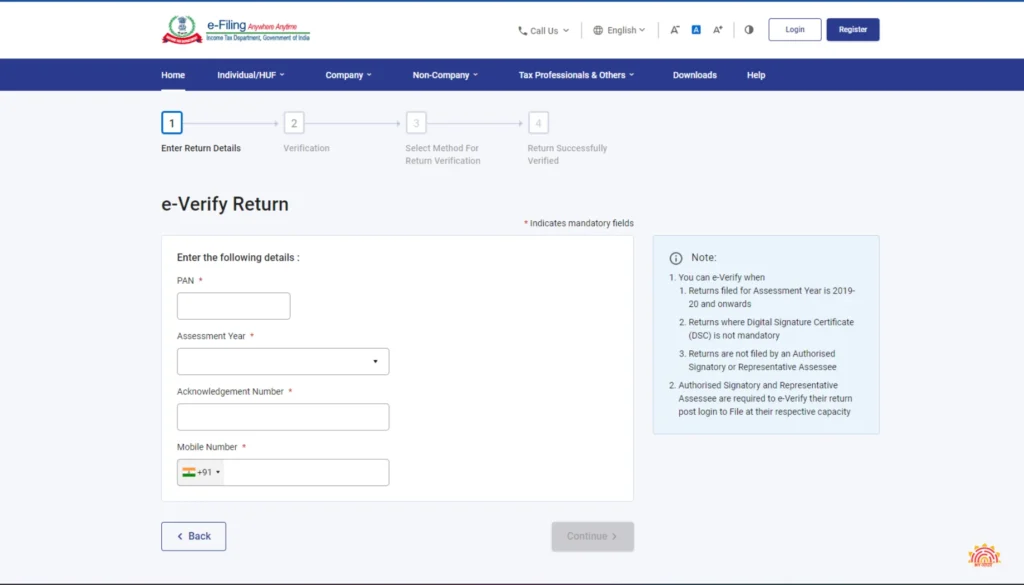

The steps to connect your Aadhaar with Dish are basic and simple to take after whichever way you select. We have attempted our best to supply you the steps and the supporting screenshots to assist you with the connecting.

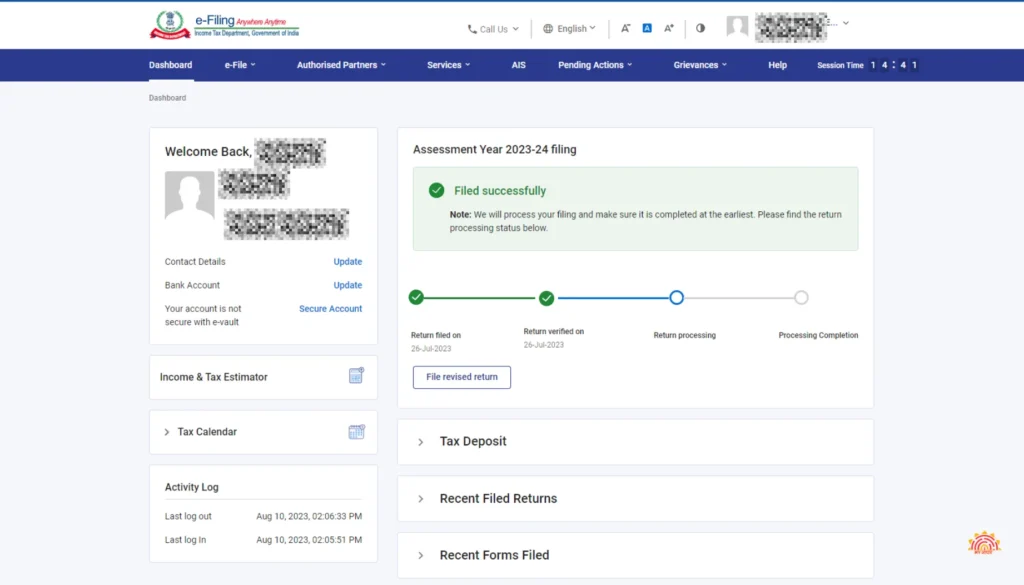

Registered users of the Income Tax e-Filing Portal

In the event that you have got enlisted on the Wage Charge e-Filing portal to file your assess returns, you’ll be able interface your Aadhaar beneath the Profile Settings tab using the ‘Link Aadhaar’ option.

Click on the ‘Registered Client? Login Here’ button. You may be required to enter your PAN number, the watchword and the Captcha given on the page to login. Once you login, you’ll be displayed with a screen comparable to the one underneath. Here, go to the ‘Profile Settings’ tab and tap on ‘Link Aadhaar’ option

Registered clients of the Pay Tax e-Filing portal

In numerous cases, the connecting is as of now done by the entrance based on your past charge records. So, after you press on this alternative, you might get a message like “Your Dish is as of now connected to Aadhaar number XXXX XXXX 1234”. In the event that they are not connected, you may get a shape to enter your points of interest like Title, Date of Birth and your Aadhaar card number. The title and date of birth ought to be because it is precisely printed on your Aadhaar card. These points of interest ought to coordinate along with your Skillet points of interest. In the event that the data matches, the connecting will be effective and you’ll get a affirmation message on the screen.

Users have to note that the points of interest on the Aadhaar card ought to be an correct coordinate with the ones on the Dish card. The numbers will not be connected in the event that there are contrasts within the subtle elements on these two cards

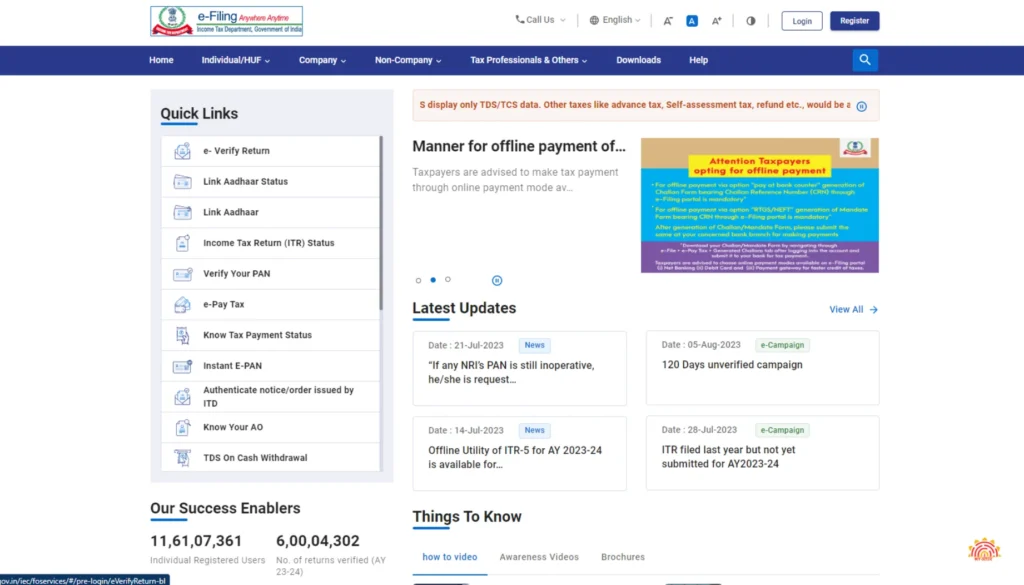

For Non-registered users of the income tax e-filing portal

Clients who don’t have a enlisted account on the entrance require not worry. They can basically utilize an alternative accessible on the homepage to interface their Aadhaar with their Container. On the homepage of the official wage tax portal domestic, you’ll see an alternative that says ‘Link Aadhaar’. Tap on that.

For Non-registered users of the Pay Assess e-Filing portal

Here, you have got to enter your Container, Aadhaar and your title because it shows up on the Aadhaar and the Captcha given. In a few cases where the Aadhaar was created in introductory days, it did not contain the total Date of Birth of the candidate, but only the year of birth. There’s an alternative on this page to say that as well. You’ll be able check the box that says, ‘I have as it were year of birth on my Aadhaar Card’. Once all the subtle elements are entered and you hit ‘Link Aadhaar’ the connecting will be done and a affirmation message is shown on the screen.

PAN and AADHAAR linking via SMS

Income tax department provides a convenient link to link Aadhaar and PAN through SMS. Users should send SMS to 567678 or 56161 in the following format –

UIDPAN Space Space

Eg: UIDPAN 888888888888 ABCDE1234Z

Points to remember while linking Aadhaar with PAN

- Name, date of birth and other Aadhaar details should match with PAN details. The system will not accept to connect if this information is inconsistent.

- User advised to update PAN card details to match Aadhaar card details for hassle free linking. Users can update their PAN card details from this link

- The OTP will be sent to the mobile number registered in Aadhaar. Ensure that the phone number provided during Aadhaar re-enrolment is active and available to receive the message. You need to enter the OTP to confirm the link.

- Linking Aadhaar with PAN is mandatory for filing ITR return. Although the system may allow you to submit your IT return form online, the assessee may not process the reports due to lack of Aadhaar linking with PAN.

What will happen if PAN is not linked with Aadhaar before the deadline?

The Income Tax Department said that PAN cards not linked to Aadhaar are called non-functional. While the amended provision of the Income Tax Act, 2019 calls for clarity on what is meant by “non-functional”, Section 139AA(2) of the Income Tax Act provides that PAN not linked to Aadhaar shall not be considered non-functional. in government use longer. There is no clear definition of what is meant by “dormant” and no mention of reactivation of such “dormant” PANs.

What if I don't have PAN?

You will automatically get a new PAN number! According to a notification issued by the CBDT in August 2019, a person who has not been allotted a permanent account number but has an Aadhaar number and has submitted it instead of PAN will be deemed to have applied for PAN and will not be required to. apply or send specifically for the purpose intended documents.

However, as per the notification, in this case you will have to verify your Aadhaar number. In an earlier press release, CBDT Chairman P.C.Mody reiterated that the department will issue a new PAN to a person who files income tax returns using only Aadhaar, “Suo Motu”. This is done as part of a new arrangement to merge the two databases. He says, “In case Aadhaar is lent and there is no PAN, we could think about what are the conditions for issuing PAN to a person (who files income tax returns). As per the law, the assessee gets Suo Motu Do if Aadhaar is lent without PAN, I will give him Metu. It will be tied.”

Frequently Asked Questions

Ans: Linking Aadhaar with your PAN card is essential for various financial transactions, income tax filing, and to curb tax evasion. It helps in accurate identification and verification of taxpayers.

Ans: You can link your Aadhaar card with your PAN card online through the Income Tax Department's official website or through SMS. The process is simple and involves providing your Aadhaar and PAN details.

Ans: Yes, as per regulatory guidelines, linking Aadhaar with PAN card is mandatory for individuals who possess both documents.

Ans: The deadline for linking Aadhaar with PAN card may vary based on regulatory updates.

Ans: No, the linking process is typically done online through the Income Tax Department's portal or through SMS.