How To Link Aadhaar Card With Your Bank Account

The Aadhaar system has been rife with speculation about its validity and its integration with various public services across the country. The Supreme Court confirmed the validity of the constitution, but made its connection to bank accounts, mobile services and other services used by consumers optional. However, bankers have expressed their preference for Aadhaar as a convenient ID for opening a bank account.

Aadhaar works together as proof of identity, proof of address and proof of age, freeing customers from submitting various documents for the purpose. Aadhaar was created as a springboard for Digital India and remains the document of choice for many due to its ease of use. Linking Aadhaar with your bank account can easily be done online or even through an ATM. Today everyone has an online banking account or at least an ATM card that allows you to link your Aadhaar with your bank account in a few simple steps

How to link Aadhaar card with your bank account

Option 1: Linking Aadhaar through Internet Banking

This is the easiest way to link Aadhaar with your bank account. The process is similar for most banks, although the exact terms and options used may vary slightly.

- Log in to your “Internet Bank” account.

- From the Service Requests tab, select the ‘Link Aadhaar to My Account’ option.

- Enter your Aadhaar number and fill in the fields on the page

- Check the information yourself and click “Submit”

- You will receive a confirmation message when the connection is complete

- The bank may take time to verify the information and connect the numbers

- Customer will be notified by email or text if connection is successful

Option 2: Linking Aadhaar through Bank Branch

People who do not have internet banking simply walk into the nearest bank branch and link their Aadhaar number to their bank account.

- Get the prescribed form for Aadhaar linking

- Fill the form correctly with all the information

- Attach the attested copy of your Aadhaar card along with the form and submit it

- The bank may take a few days to verify the information and link the numbers

- If the connection is successful, you will receive a message via email or text message

Option 3: Linking Aadhaar through SMS service

Smart devices are spread across the country, so linking Aadhaar to your bank account is just a matter of seconds. You can do this by sending a single text message.

- Minor changes in SMS format may occur between banks. But the most common form looks similar

- 12 digit Aadhaar no. bank account number

- the number to send this message to also varies from bank to bank. E.g. SBI requires SMS to 567676, UCO bank number is 9231008888, Bank of India number is 9289592895, Kotak Mahindra bank number is 5676788, Citibank number is 9880752484, P60704 number is 5,60. etc. – this message can only be sent from the mobile phone number registered to the bank account

- After the bank has verified the information, the customer will receive a confirmation message via text message or email

- This process can take 24-48 hours.

Option 4: Linking Aadhaar through ATM

It hardly takes a few minutes and is also the easiest. Most banks have the facility to link Aadhaar through ATMs. Although the labels and options may vary, they mainly include the following steps.

- Swipe / insert your ATM card

- Confirm by entering your ATM card PIN

- Select an option that allows you to send service requests

- Click on the option to link your Aadhaar with your bank account

- Enter your 12 digit Aadhaar number and submit

- You will see a confirmation message on the screen

Option 5: Linking Aadhaar through Mobile Banking IVR

If you don’t have internet banking or access to the nearest ATM or branch, you can link Aadhaar to your bank account by calling your bank’s mobile banking services.

- Call your bank’s mobile service number. The number varies from bank to bank. – Select option to link Aadhaar from IVR

- You need to enter your 12 digit Aadhaar number

- Confirm the number again and select the option to confirm it

- You will receive an IVR confirmation message and a text message or email when you are ready

How to confirm Aadhaar linking status with your bank account?

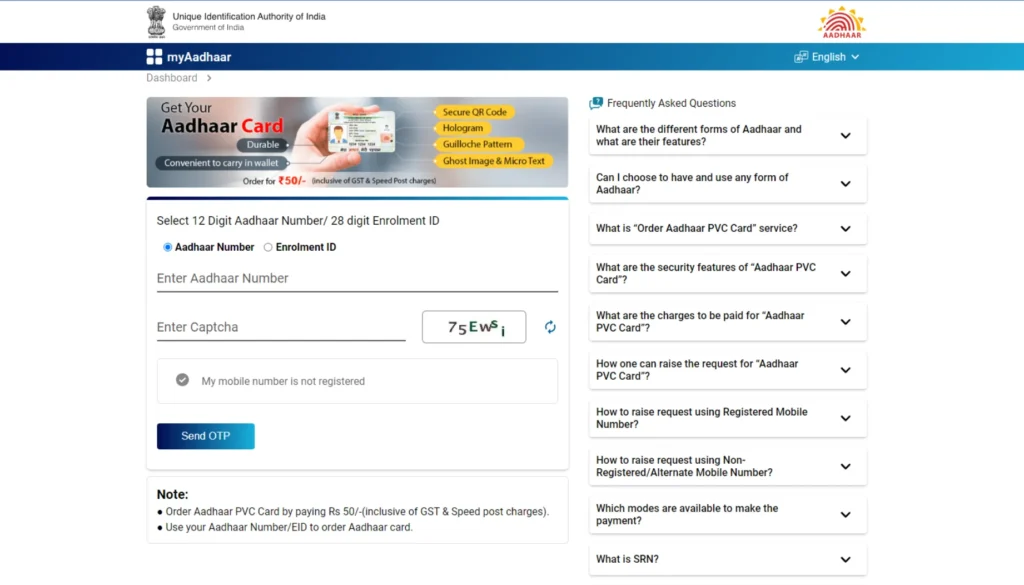

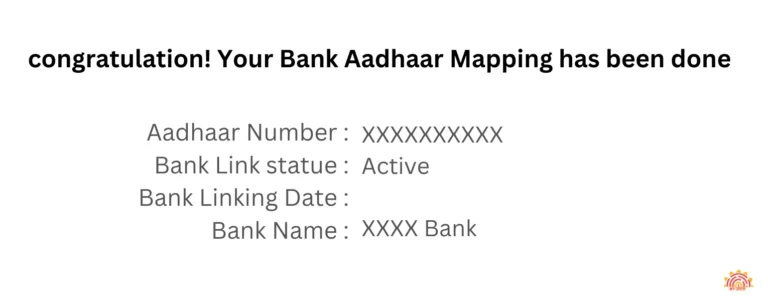

If the customer does not receive the link confirmation message, they can check the status on the UIDAI website.

In this page you have to enter your Aadhaar number and given captcha.

Once you click on the “Send OTP” button, the OTP will be sent to the mobile number registered in Aadhaar. Once the OTP is verified, the bank account number associated with the Aadhaar number will be displayed on the screen.

Can I link more than one bank account with Aadhaar?

To answer this question, users need to understand the background behind linking a bank account with Aadhaar. Banks, after receiving the customer’s Aadhaar number, add it to the customer’s account details maintained in the core banking system and regularly upload such Aadhaar numbers to the NPCI mapper. Now, the NPCI mapper is a repository of Aadhaar numbers associated with a particular bank, which is used to route Aadhaar-based payment transactions to target banks. This method was mostly used to compensate for the government’s own subsidies.

Therefore, when a customer requests to link their bank account with Aadhaar, the information is updated in the NPCI database. Thus, NPCI fetches the latest updated bank details to complete Aadhaar based payment transactions in target banks. So, even if you link multiple bank accounts with your Aadhaar, the last updated bank account will be counted as ‘Last In First Out’.

Frequently Asked Questions

A: Linking Aadhaar with your bank account helps in various ways, including receiving government subsidies, streamlining financial transactions, and complying with regulatory requirements.

A: While it was initially made mandatory, the Supreme Court has ruled that it's not necessary for all services. However, specific services like government subsidies might require Aadhaar linkage.

A: You can link Aadhaar with your bank account through various methods, including online banking, mobile banking apps, ATM, or by visiting the bank branch in person.

A: Generally, you need your Aadhaar card and a copy of it, along with your bank account details. Some banks might require additional identification documents.

A: While there was a deadline initially, it has been extended multiple times. It's best to check with your bank for the latest information.

A: Yes, many banks offer online facilities to link Aadhaar with your bank account through their internet banking or mobile banking apps