Link Aadhaar Card To Income Tax Return

Income tax filing has gone completely digital for the benefit of Indian taxpayers. The official income tax website is a one stop shop for all income tax related services. The user interface is very easy to navigate and anyone with little computer knowledge can file the income tax return properly.

The government has made it mandatory to link your Aadhaar account with your Income Tax account on the official website. Now you have to mention your Aadhaar while filing income tax and also while applying for PAN card. The purpose of this measure is to increase the authenticity of the statements made and also to increase the number of statements made during the reporting period. As Aadhaar is now authorized for large cash payments, it also prevents the menace of black money.

It also draws attention to the announcement made by our current Finance Minister in Budget 2019 regarding the interchangeability of PAN and Aadhaar. According to current laws, only Super Seniors (over 80 years old) are allowed to file income tax return in paper form. All others must submit their statements electronically on the e-file website. With the PAN and Aadhaar interchangeable feature, users without PAN can still file returns using Aadhaar. Their Aadhaar account must be linked to their Income Tax account so that the Assessing Officer (AO) can process their returns.

Link your Aadhaar card to your Income Tax Return (ITR) online:

To link your Aadhaar card to your Income Tax Return (ITR) offline, follow these steps:

- Download Form: Download the Aadhaar Linking Form (Form ITR-V) from the official Income Tax e-Filing portal or collect it from your nearest Income Tax office.

- Fill Out the Form: Complete the Aadhaar Linking Form with accurate information. Ensure that the details provided match those on your Aadhaar card.

- Attach Required Documents: Attach a self-attested copy of your Aadhaar card along with the Aadhaar Linking Form.

- Submit at Local Income Tax Office: Visit your nearest Income Tax office and submit the filled-out Aadhaar Linking Form and the attached documents.

- Acknowledgment Receipt: The Income Tax office will provide you with an acknowledgment receipt as proof of submission.

- Verification and Processing: The Income Tax department will verify the information and process the Aadhaar linking request.

- Confirmation: You will receive confirmation of the successful linkage of your Aadhaar card with your Income Tax Return.

- Check Status (Optional): If available, you can check the status of Aadhaar linking through the Income Tax e-Filing portal or by contacting the Income Tax office.

Remember to carry valid identification and copies of required documents when visiting the Income Tax office for the Aadhaar linking process.

Link your Aadhaar card to your Income Tax Return (ITR) offline:

Here’s a step-by-step guide to link your Aadhaar card to your Income Tax Return (ITR) online:

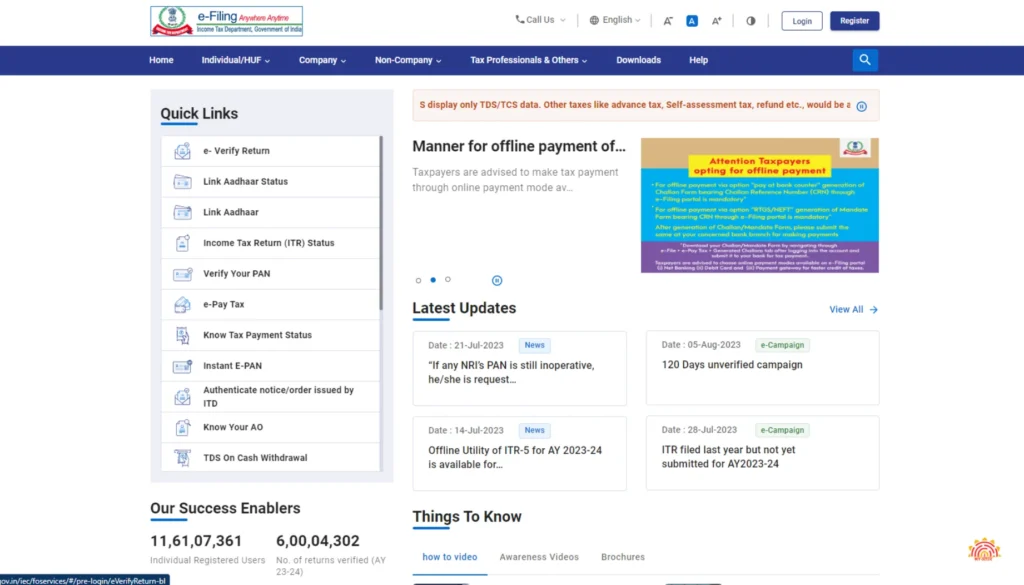

- Visit Income Tax e-Filing Portal: Go to the official Income Tax e-Filing portal using a web browser.

- Log In to Your Account: Log in to your e-Filing account by entering your User ID (PAN), password, and captcha.

- Access “Profile Settings”: After logging in, navigate to the “Profile Settings” section.

- Choose “Link Aadhaar”: Within “Profile Settings,” select the option to “Link Aadhaar.”

- Provide Aadhaar Details: Enter your 12-digit Aadhaar number and ensure accuracy.

- Verify through OTP: An OTP (One-Time Password) will be sent to your registered mobile number linked with Aadhaar. Enter this OTP to verify your Aadhaar.

- Link Aadhaar: Upon successful OTP verification, your Aadhaar will be linked to your e-Filing account.

- Check Aadhaar Linking Status: You can confirm the status of Aadhaar linking by choosing the “View Aadhaar Status” option.

Always make certain that you are using the official Income Tax e-Filing portal and following the correct steps to link your Aadhaar card with your Income Tax Return. This linking process is crucial for a smooth income tax processing and adherence to regulatory requirements.

Now let's see "How to Link Aadhaar with your Income Tax Email Account"

If you are a registered user on the official eForm website and have mentioned your Aadhaar number earlier in your tax return, your Aadhaar number is probably already pre-populated. This information is pre-populated in the General Information section of ITR-1 Part A.

For first-time users and others who don’t have an account, follow these steps.

Step 1:

Visit the Income Tax website at https://www.incometax.gov.in/iec/foportal/

Step 2:

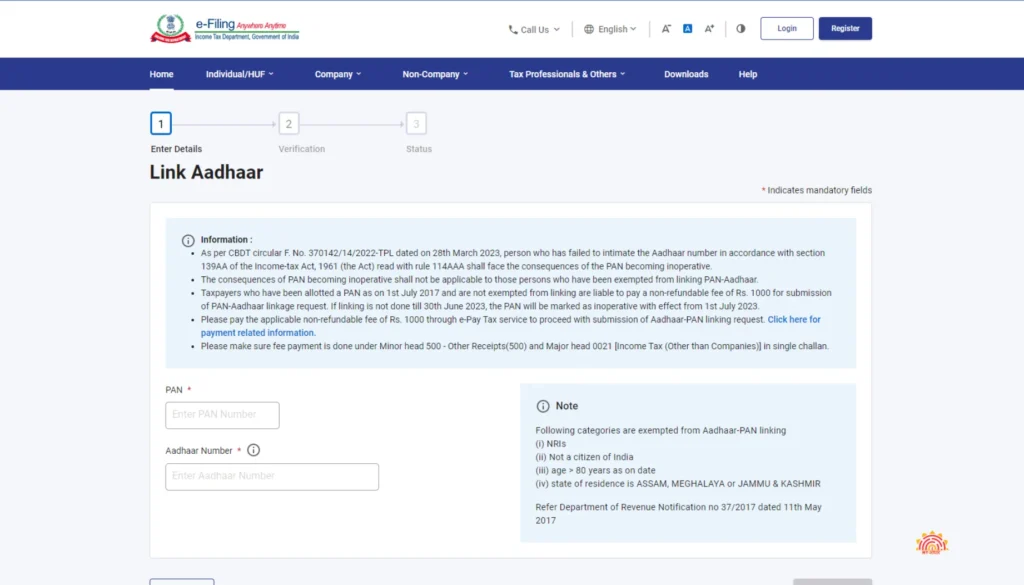

Click on “Link Aadhaar” on the left side of the page

Step 3:

You will be directed to the next page where you enter your PAN, Aadhaar number and name as it appears on the Aadhaar card.

Step 4:

After entering all the details, click on the “Link Aadhaar” button to complete the process.

How to Check Aadhaar Link Status?

Go to “Link Aadhaar” on the home page of the e-file web page.

On the bottom screen, click the flashing “Click Here” button in the upper left corner of the screen.

On the next screen you have to enter PAN and Aadhaar and click on “View Aadhaar Link Status” button

Once the connection is made, you will receive a confirmation message below.

Benefits of Linking Aadhaar with Income Tax Account

Linking your Aadhaar with your Income Tax account offers several benefits:

- Simplified Filing: Aadhaar linkage simplifies the income tax filing process by pre-filling certain details, reducing errors and saving time.

- Faster Processing: Linked Aadhaar ensures faster processing of your income tax return and quicker refunds, if applicable.

- Reduced Fraud: Aadhaar linkage helps in curbing tax evasion and identity fraud by establishing accurate taxpayer identity.

- Easy Verification: Aadhaar-linked returns are easily verified and processed by the income tax department.

- Government Benefits: Linked Aadhaar allows you to avail government benefits and subsidies directly into your bank account.

- Avoid Notices: Linking Aadhaar reduces the likelihood of receiving notices from the income tax department due to discrepancies.

- Ease of Compliance: Compliance with income tax regulations becomes more streamlined and hassle-free.

Frequently Asked Questions

A. Linking Aadhaar to ITR helps in simplifying the filing process, verifying your identity, and ensuring seamless processing of your tax return.

A. As of my knowledge cutoff in September 2021, while it's not mandatory for all taxpayers, it's advisable to link Aadhaar with ITR to enjoy the benefits of quicker processing and easier verification.

A.You can link your Aadhaar card to your ITR online by logging into your e-Filing account, accessing "Profile Settings," selecting "Link Aadhaar," providing Aadhaar details, and verifying through OTP.

No, you can link only one Aadhaar card to your ITR. It's linked at the individual taxpayer level.

A.Ensure that your name on both documents matches. If not, update your Aadhaar or ITR to match the correct name.