Are you tired of dealing paperwork and waiting for endlessly for your PAN card? Well, freat no more because the Finance Ministry has introduced a revolutionary way to obtain your PAN card instantly – all thanks to your Aadhaar number!

The objective behind the initiative is to simplifying the process of obtaining a PAN card for indian citisens, ensuring tax compliance and combatting the menace of black money. Equipping individuals with a PAN card not only facilitates financial transactions but also aids in preventing tax evasion as well asfinancial crimes.

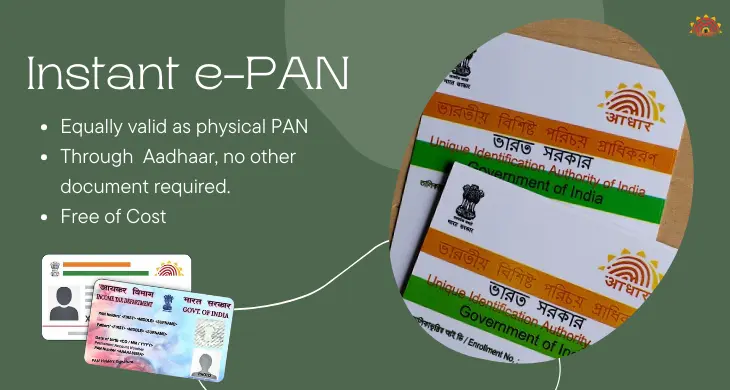

So, who can benefit from this Instant PAN service? Anyone with a valid Aadhaar number but without a PAN card can take advantage of this seamless process. And the best part? It’s completely free!

Instant PAN through Aadhaar in just a few easy steps:

1. Visit the Income Tax e-filing website.

2. Click on the ‘Instant PAN through Aadhaar’ option under Quick Links.

3. Select ‘Get New PAN’ and enter your Aadhaar number.

4. Complete the Captcha and confirm your details.

5. Generate and enter the Aadhaar OTP provided.

6. Verify your Aadhaar information.

Once submitted, you’ll receive an acknowledgment number on your registered phone and email.

Now, how do you download your e-PAN? Follow these steps:

1. Visit the Income-tax Department’s e-Filing website.

2. Navigate to ‘Instant PAN using Aadhaar’ and check the PAN status.

3. Enter your Aadhaar number and OTP.

4. If your PAN has been assigned, download the e-PAN PDF.

You now have your Instant PAN card ready to use.

Aadhaar Based Instant PAN

The PDF contains a QR code with essential details like the applicant’s name, date of birth, and photo. You can get the e-PAN from the income tax e-filing portal using the 15-digit acknowledgment number. Additionally, a soft copy of the e-PAN will be sent to your registered email address.

While you can apply for an e-PAN on the NSDL and UTITSL websites, there might be a fee involved. However, obtaining an e-PAN is free of cost through the income tax e-filing portal. When you use this method to apply for a PAN, your Aadhaar number gets automatically linked to your PAN.

But before you dive in, here are some FAQs addressed:

– Is e-PAN valid? Absolutely!

It includes a QR code with all your details.

– Can I apply if I’ve lost my Aadhaar card?

Unfortunately not, you need it for verification.

– Is there a cost for instant PAN through aadhaar?

Nope, it’s entirely free!

– What if my Aadhaar info is incorrect?

Ensure it’s updated before applying.

Do I need to submit any physical copy of KYC for application as proof of Aadhaar card?

No. The process is completely online. Not any paperwork is required.

In conclusion, this initiative aims to simplify the PAN application process, promoting financial inclusion and transparency. So, say goodbye to paperwork and hello to hassle-free tax compliance with your Instant PAN through Aadhaar!

Stay tuned for more updates and tips on navigating the world of finance effortlessly. Happy filing!